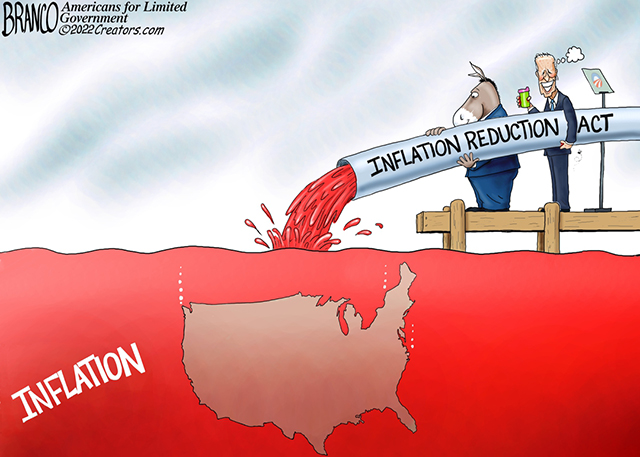

Judge temporarily blocks implementation of White House’s latest student debt forgiveness scheme

09/10/2024 / By Laura Harris

A judge has temporarily blocked the implementation of the White House’s latest student debt forgiveness plan, just days after seven Republican-led states filed a lawsuit to halt it.

On Sept. 3, Missouri, Alabama, Arkansas, Florida, Georgia, North Dakota and Ohio sued the Department of Education to block the administration of President Joe Biden and Vice President Kamala Harris from providing full or partial debt relief to certain student borrowers.

For instance, borrowers who owe more than their original loan amount could receive up to $20,000 in interest forgiveness, while low-income borrowers and those enrolled in income-driven repayment plans might see all accrued interest canceled. Single borrowers earning $120,000 or less, and married couples earning up to $240,000, could qualify for full interest cancellation. The most costly aspect of the new plan is forgiving accrued interest, which could benefit up to 26 million borrowers and is estimated to cost $62 billion over the next decade.

The states argued that the department lacks the authority to implement such debt forgiveness. They noted that this could lead to the unlawful forgiveness of $73 billion in student debt almost instantly. The total estimated cost of the plan is $146.9 billion over 10 years.

This could negatively impact state economies and entities managing federal student loans. Additionally, the Republican state attorneys general claimed they had obtained documents that the department had been actively preparing to roll out the new plan even before its official approval.

“Through cloak and dagger, the department has thus finalized a rule with a rollout plan that is maximally designed to forgive tens or hundreds of billions of dollars without any judicial review and is designed to boost the incumbent Democratic presidential candidate two months before the election,” the lawsuit stated.

“Defendants’ unusual decision to ask people to confirm whether they want to opt out of a program before it is even published created concern that defendants are planning to unlawfully rush out the third mass cancellation rule to cancel as much debt as possible, creating a fait accompli before anybody has time to challenge the action.”

Moreover, the states sought to block any future actions by the administration before they were fully implemented. They argue that quick intervention is necessary because it becomes nearly impossible to reverse the action once loans are forgiven.

“It does not matter how many rules [the education secretary] breaks in the process, so long as he forgives billions of dollars in debt before the courts stop him,” the states argue in their filing.

Chief Judge of the U.S. District Court for the Southern District of Georgia J. Randal Hall ruled in favor of the states on Sept. 5.

“This is especially true in light of the recent rulings across the country striking down similar federal student loan forgiveness plans,” Hall wrote in his decision. He issued a temporary restraining order to prevent the department from moving forward with the plan until a hearing scheduled for Sept. 18.

The rule could impact an estimated 27.6 million borrowers if finalized.

Missouri attorney general hails the decision as the court sided with them

The lawsuit marks the third major challenge to the proposed plans, following previous lawsuits that have temporarily halted attempts to forgive billions in student loans.

In June 2023, the Supreme Court struck down the administration’s initial plan which sought to cancel up to $20,000 in federal student loans for eligible Americans. The move was expected to benefit approximately 43 million borrowers. Subsequently, a revised plan was introduced, only to face another nationwide preliminary injunction. The injunction put the revised plan on hold. (Related: Biden administration SUED over student debt forgiveness plan.)

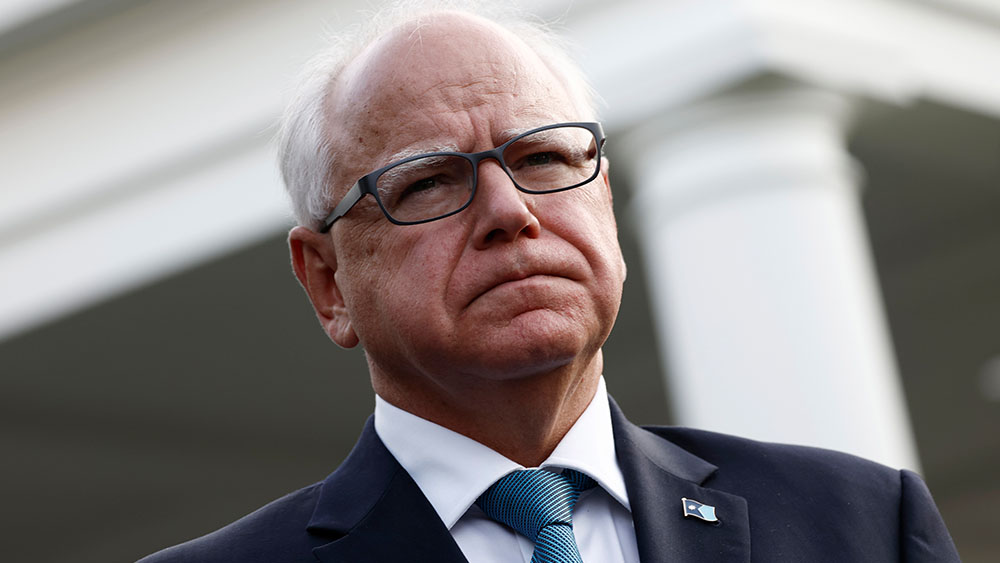

Missouri Attorney General Andrew Bailey hailed the decision.

“Today is a huge victory for every working American who won’t have to foot the bill for someone else’s Ivy League debt,” he said. “We successfully halted their first two illegal student loan cancellation schemes; I have no doubt we will secure yet another win to block the third one. They may be throwing spaghetti at the wall to see what sticks, but my office is meeting them every step of the way.”

Visit DebtCollapse.com for more stories about student loans.

Watch this clip from Fox Business detailing how Biden’s new Supreme Court-subverting student loan forgiveness plan could cost American taxpayers over $475 billion over the next 10 years.

This video is from the News Clips channel on Brighteon.com.

More related stories:

DEBT REVOLUTION? Tens of millions of student loan borrowers stage “massive student debt strike.”

Taxpayer money going down the drain: Biden circumvents SC decision, cancels $72M in student debt.

Biden’s budget request for fiscal 2025 includes $12 billion for student loan forgiveness.

Sources include:

Submit a correction >>

Tagged Under:

big government, Bubble, debt bomb, debt collapse, debt forgiveness, deception, government debt, insanity, Joe Biden, Missouri, money supply, national debt, risk, student loan forgiveness, student loans, Taxes, taxpayers, White House

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 PENSIONS.NEWS

All content posted on this site is protected under Free Speech. Pensions.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. Pensions.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.