DEBT SURGE ALERT: $8.9T government debt to mature, $1.4T budget deficit expected in 2024

02/14/2024 / By Belle Carter

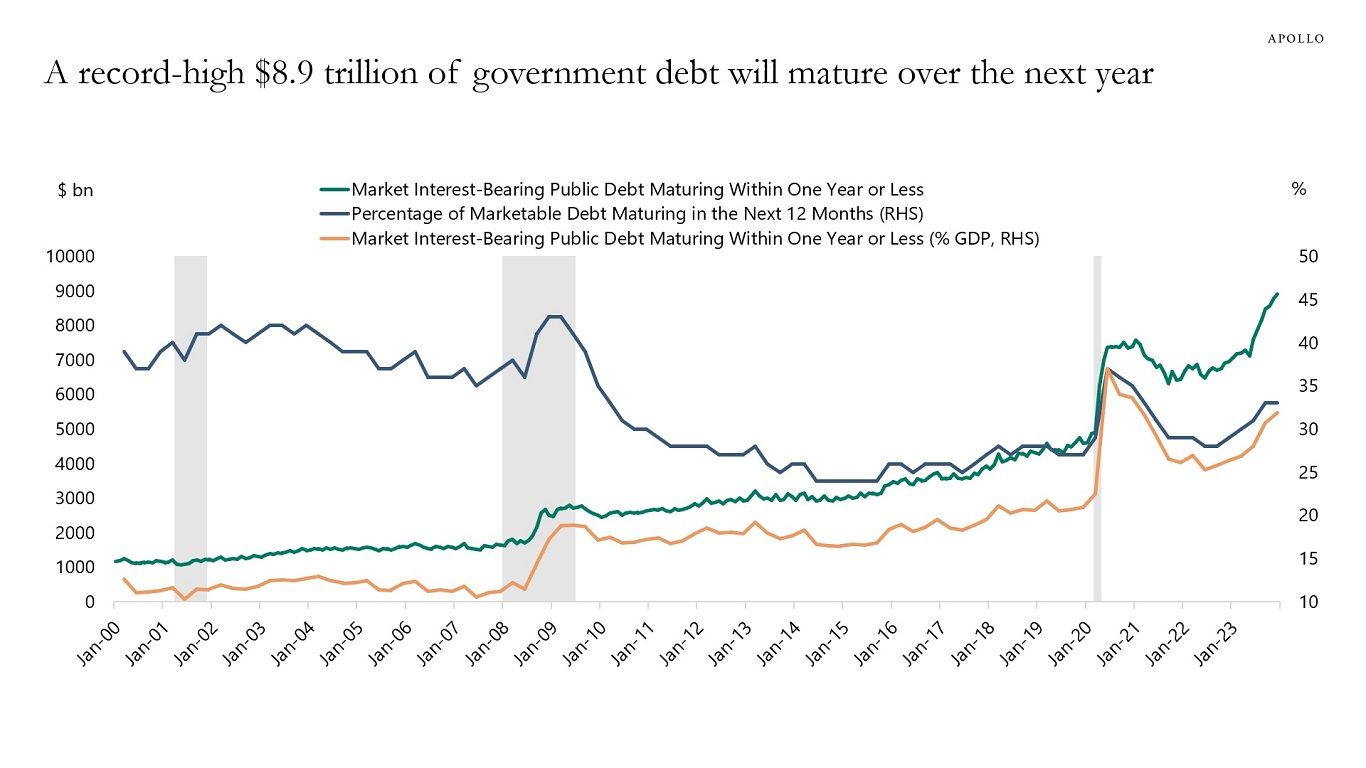

The Congressional Budget Office (CBO) said that the government budget deficit will be $1.4 trillion and a record-high $8.9 trillion of national debt is set to mature in the coming year – this means more than $10 trillion in U.S. treasuries are coming to the market in 2024.

The Federal Reserve has also been running down its balance sheet by $60 billion per month. The bottom line, experts said, is that someone will need to buy more than the said amount in U.S. government bonds. It is more than one-third of the U.S. outstanding federal debt and more than one-third of the country’s gross domestic product (GDP).

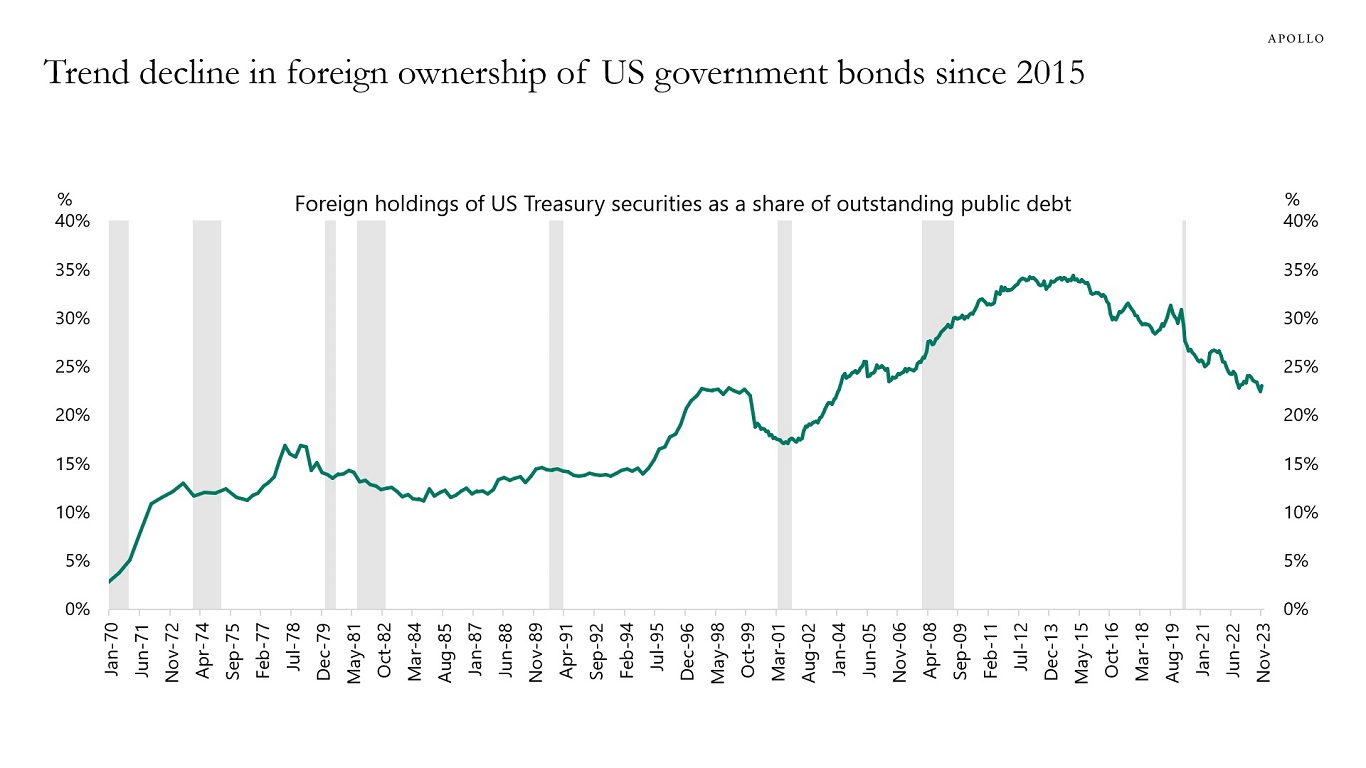

According to education platform Apollo Academy’s Chief Economist Torsten Slok, this is going to be a particular challenge when the biggest holders of U.S. Treasuries, such as foreigners, continue to shrink their share. Apollo’s market analysis has provided a chart showing the decline of the U.S. government bonds’ foreign ownership. More fundamentally, interest rate-sensitive balance sheets such as households, pensions and insurance have been the biggest buyers of Treasuries in 2023, and the question is whether they will continue to buy once the Fed starts cutting rates.

Last year, Apollo reported $7.6 trillion in interest-bearing U.S. public debt to mature in 2023, representing 31 percent of all outstanding U.S. government debt that added upward pressure on rates. The forecast included that the numbers are set to keep on rising in the next years.

Research fellow analyzes record-breaking government debt

The year 2023 ended with the federal debt surpassing a record-breaking $34 trillion. According to American Institute for Economic Research (AIER) senior research fellow Peter C. Earle, Ph.D., last year’s $2.65 trillion addition to the debt is the second largest annual increase in history after the 2020 increase of $4.5 trillion. Now in a year where geopolitical hotspots are on the rise, namely the Russia-Ukraine and Israel-Hamas conflicts that are currently expanding across multiple fronts, the ratio of the current U.S. debt pile to annual economic output. (Related: Government debt surpasses $34 TRILLION mark just FOUR MONTHS after it hit $33 trillion.)

“At $34 trillion that ratio is 1.2, whereas the debt-to-GDP ratio at the end of World War II was 1.1 in an era of a managed gold standard with few international competitors. If a war footing were suddenly called for, only the colossal monetization of debt would suffice,” Earle said in an article on the AIER website. He added that over the two years, the debt assumed has additionally been incurred at much higher interest rates and the Fed began hiking rates on March 16, 2022, when the debt level had just surpassed $30 trillion and the effective rate was 0.08 percent.

Earle also said that it is understandable that repeated warnings about the increasing debt incurred by the government would fall upon increasingly “disinterested ears.” The Treasury Department said a series of routine financial transactions during the day pushed the debt total beyond the symbolic trillion-dollar barrier. The debt figure had topped $999.3 billion earlier in January, and then held steady for the next four business days as the Treasury’s redemption of old securities nearly matched its issuance of new ones.

“Personally, I am inclined to guess that whatever the end game of skyrocketing government debt is, the U.S. is closer to it than to the beginning, but that too might be wrong,” Earle said. “In October 1981, no one would’ve believed that 15-and-a-half thousand days and $33 trillion in debt later there would still be a market for U.S. Treasury securities, or that the dollar would still be the global reserve currency.” He suggested ignoring numerical benchmarks when it comes to borrowing. “The government will never, ever, voluntarily cut spending. When at some point the issuance of Treasury bonds is no longer an option for some reason or another, some combination of the destruction of the dollar’s value and increasingly confiscatory levels of taxation will follow,” he pointed out, adding that American citizens will need to find a means of arresting the Beltway’s profligate instinct for self-preservation.

Also, although only one-quarter of the government debt is currently owned by foreign creditors, the prospect of having our fates controlled by outside powers with interests that diverge vastly from ours should be menacing. At the very least, U.S. citizens should consider what they are willing to live without or see others live without, he said citing Medicare, the U.S. Coast Guard, pension backstops, the Food and Drug Administration and subsidies for just about everything.

Check out DebtBomb.news for more news on the exploding and record-high national debt of the United States.

Sources for this article include:

Submit a correction >>

Tagged Under:

balance sheet, big government, bonds, Bubble, budget deficit, central bank, Collapse, debt bomb, debt collapse, economic riot, Federal Budget, federal debt, financial collapse, government debt, government spending, Inflation, national debt, risk, stocks, subsidies, T-bills, treasuries

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 PENSIONS.NEWS

All content posted on this site is protected under Free Speech. Pensions.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. Pensions.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.