Century-old trucking giant Yellow Corp ceases operations, leaving 30,000 employees jobless and America’s supply chain reeling

08/03/2023 / By Belle Carter

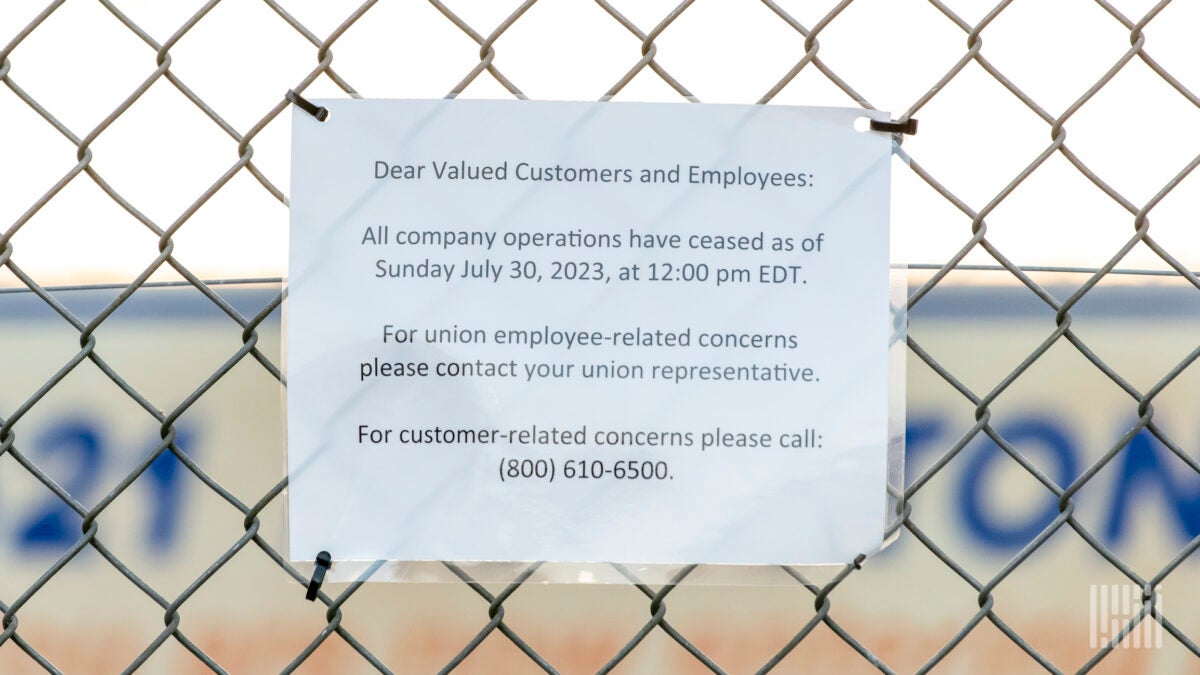

The trucking industry’s third-largest less-than-truckload (LTL) carrier Yellow Corp stopped operations on Sunday afternoon and Teamsters Union, which represents the company’s workforce, said it had been notified of a pending bankruptcy filing.

“Today’s news is unfortunate but not surprising. Yellow has historically proven that it could not manage itself despite billions of dollars in worker concessions and hundreds of millions in bailout funding from the federal government. This is a sad day for workers and the American freight industry,” Teamsters General President Sean M. O’Brien said in a press statement released early Monday.

The fifth-largest transportation company in the U.S. faced a massive $1.3 billion debt, with loans maturing next year.

A sign posted on terminal gates on July 30. 2023. (Photo credit: FreightWaves’s Jim Allen)

“The Teamsters had made a series of painful concessions that brought them close to wage parity with nonunion carriers,” said Tom Nightingale, CEO of AFS Logistics, a third-party logistics firm that places about $11 billion worth of freight annually with different trucking companies on behalf of shippers. He said the company began taking on a significant amount of debt 20 years ago in order to acquire other trucking companies.

The shutdown also came amid its ongoing standoff against the International Brotherhood of Teamsters. It attempted to modernize through its “One Yellow” initiative, with the purpose to integrate its regional networks into one. But the proposed changes faced union opposition since they affected the hourly wage rate and duties of nearly 1,000 truck drivers. The firm sued Teamsters in June over allegations of blocking the restructuring plans. It lost the case but managed to avert the threatened strike earlier this month. Last week, the company also declined to contribute to its employees’ pension and health insurance plans, nearly prompting another strike.

The closure would leave 30,000 of its employees without jobs, including around 22,000 Teamsters members. Hundreds of its nonunion employees were laid off last Friday after the company ceased accepting new shipments from customers.

Walmart, Home Depot, and some of the company’s largest clients as well as the logistics platform Uber Freight have already halted shipments to the beleaguered carrier company to prevent goods from being lost or abandoned in the event of bankruptcy, according to reports.

As per SJ Consulting’s President Satish Jindel, the Nashville, Tennessee-based company was not making much money because its prices have historically been the cheapest compared to other carriers. “While there is capacity with the other LTL carriers to handle the diversions from Yellow, it will come at a high price for (current shippers and customers) of Yellow,” he said.

Yellow, Roadway, and Consolidated Freightways had once been known as the Big Three of the trucking industry. CF went out of business in 2002. And with Yellow Corp. closing, the final two parts of the Big Three are now out of business as well. (Related: Driving on an empty tank: Florida trucking company files for bankruptcy as transportation demand plummets.)

Yellow shutdown to impact American taxpayers too

Employees and clients are not the only stakeholders to be impacted by the Yellow shutdown. It will also affect U.S. taxpayers.

According to CNN Business, the company received a $700 million loan from the federal government in 2020. The loan was granted during the pandemic, despite the fact that at the time it was facing charges of defrauding the government by overbilling on shipments of items for the US military. It eventually settled the dispute without admitting wrongdoing but was forced to pay a $6.85 million fine.

The first tranche of the loan was $300 million, which was used to clear the deck of the company’s immediate cash needs. It covered previously delayed health care and pension plan contribution payments, lease payments on equipment and real estate, and even interest payments on its other debt, among other items. A $400 million second tranche was used to fund capital expenditures, largely the purchase of tractors and trailers, which received considerable scrutiny from industry participants. The thought on the part of the government may have been, “In for a penny, in for a pound.” Yellow estimated it would save $10,000 to $12,000 per tractor annually running newer models, and that the upgrades would be the key to reaching longer-term financial stability.

The news outlet reported that LTL’s stock lost 82 percent of its value between the time of that loan and Thursday’s close after reports of the bankruptcy plans, closing at only 57 cents a share. It bumped up 14 cents a share on Friday but still remained a so-called penny stock.

Visit SupplyChainWarning.com for more news on the collapsing logistics networks of the United States.

More related stories:

Trucking companies in Illinois, Florida, Virginia and elsewhere are FAILING as economy falters.

Illinois trucking company shuts down unexpectedly, leaving drivers stranded and unpaid.

‘Literally impossible’: Trucking companies brace for California’s electric mandate.

Michigan trucking company auctions equipment after ending 51 years of business operations.

Sources for this article include:

Submit a correction >>

Tagged Under:

bankruptcy, Bubble, Chapter 11, Collapse, debt, debt bomb, debt collapse, debtbomb, economic collapse, economic riot, freight, logistics, pandemic, supply chain, Teamsters, transportation, truckers, trucking, Yellow

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 PENSIONS.NEWS

All content posted on this site is protected under Free Speech. Pensions.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. Pensions.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.