Capitalism is ‘breaking down before our eyes,’ says prominent hedge fund manager Ken Griffin

03/16/2023 / By JD Heyes

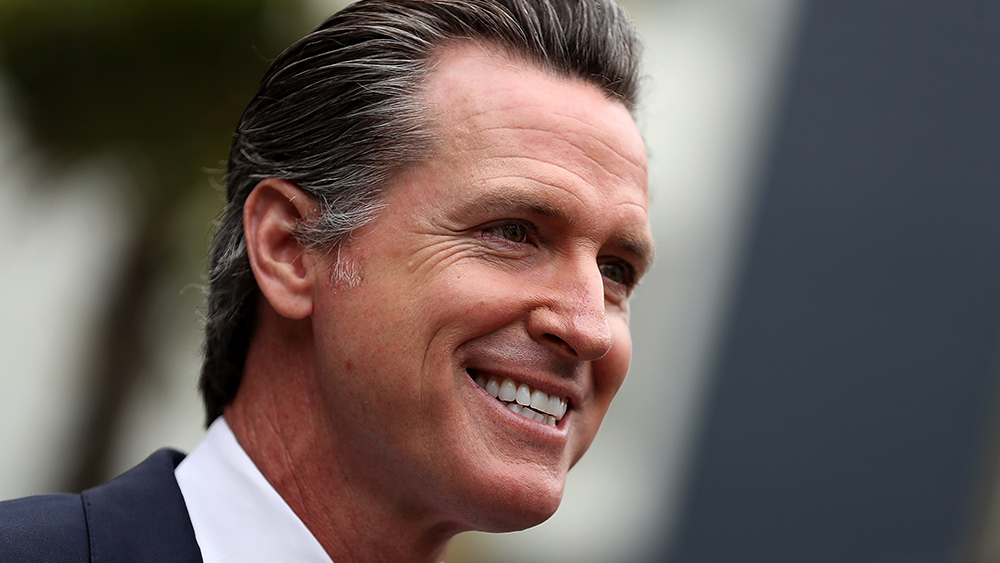

Ken Griffin, the founder of Citadel hedge fund, has stated that the Federal Reserve’s rescue package for Silicon Valley Bank is a clear indication that American capitalism is “breaking down before our eyes,” according to a report this week.

He argued in an interview with the Financial Times that taxpayers should not have to bail out institutional investors following the Fed’s intervention to prevent contagion in the US banking sector following SVB’s collapse in Santa Clara.

“The US is supposed to be a capitalist economy, and that’s breaking down before our eyes,” he said. “There’s been a loss of financial discipline with the government bailing out depositors in full.”

Griffin knows of what he speaks. He is a billionaire hedge fund manager and the founder and CEO of Citadel LLC, one of the world’s largest alternative investment management companies, with an estimated $54 billion in assets under management as of 2021.

Griffin began trading while still a student at Harvard University and launched Citadel in 1990. He has been recognized as one of the most successful hedge fund managers in the world and is known for his philanthropic efforts, particularly in education and the arts. In addition to his business and philanthropic pursuits, Griffin is also a major political donor and has been involved in numerous political campaigns and initiatives.

SVB was closed down by US regulators on Friday after customers rushed to withdraw $42 billion, equivalent to a quarter of its total deposits, in a single day. The failed effort to raise new capital raised concerns about the future of the tech-focused lender, leading to the decision to shut it down, reports noted.

On Sunday, the US Federal Reserve announced a lending facility to ensure that “banks have the ability to meet the needs of all their depositors,” according to officials. Federal officials have assured SVB and Signature Bank depositors that they would be protected from loss, even if their deposits exceeded the normal $250,000 insurance limit.

The Federal Reserve’s decision to protect all depositors’ funds with SVB has been criticized by some, who argue that it creates a moral hazard by insulating investors from the consequences of their decisions. There are also concerns about the possibility of regulators having missed warning signs leading up to the collapse of the bank, the Financial Times reported.

“The regulator was the definition of being asleep at the wheel,” said Griffin, who also argued that the U.S. economy was strong enough that the Fed did not have to step in.

“It would have been a great lesson in moral hazard,” he said. “Losses to depositors would have been immaterial, and it would have driven home the point that risk management is essential.

“We’re at full employment, credit losses have been minimal, and bank balance sheets are at their strongest ever. We can address the issue of moral hazard from a position of strength,” he added.

On the other hand, Bill Ackman, another high-profile hedge fund manager, called for the Federal Deposit Insurance Corporation to “explicitly guarantee all deposits now. Hours matter” and said that “our economy will not function effectively without our community and regional banking system” on Twitter.

Griffin also stated that he and his hedge fund, Pershing Square, had no involvement with Silicon Valley Bank, and that his personal investments in the venture capital industry accounted for “less than 10 percent” of his assets.

According to The Wall Street Journal on Tuesday, First Republic Bank announced that it has strengthened its finances by securing additional funding from the Federal Reserve and JPMorgan Chase & Co.

The outlet said the funding will help the bank shore up its finances after the collapse of SVB Financial Corp. last week. The $70 billion does not include any money that First Republic may be able to borrow through a new Fed lending facility that was created to assist banks in meeting withdrawals. Remember, ‘the Fed’ uses government money — tax dollars — to operate.

Sources include:

Submit a correction >>

Tagged Under:

bailout, bank bailouts, Citadel, Collapse, corruption, debt collapse, dollar demise, economic collapse, ESG, Federal Reserve, finance riot, First Republic Bank, government bailout, Inflation, Ken Griffin, Libtards, lies, money supply, pensions, risk, Silicon Valley Bank, SVB, taxpayer bailout, taxpayer funds, woke, woke investing

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 PENSIONS.NEWS

All content posted on this site is protected under Free Speech. Pensions.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. Pensions.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.