Gregory Mannarino: Financial system meltdown begins as engineered liquidity dries up in the market

09/14/2022 / By Belle Carter

Finance expert and full-time capital markets trader Gregory Mannarino warned that engineered liquidity is drying up in the market. Given this, he called on his followers to start preparing for the massive “economic collapse.”

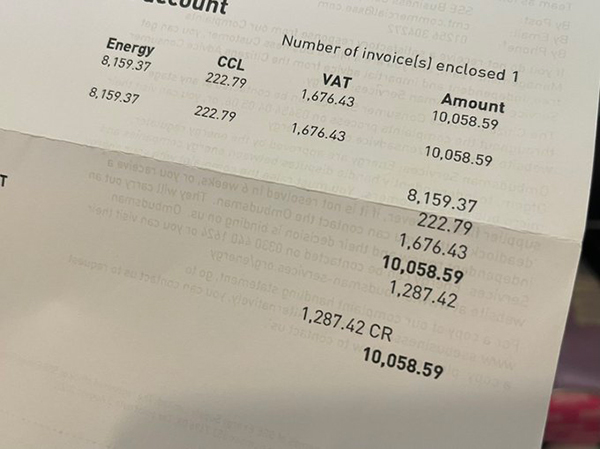

“I have been saying for 10 years at one point, a meltdown in the debt market is going to occur. You got cash bleeding on the debt market, global bond yields are rising and this is putting pressure on the stock market,” Mannarino said.

Unless the Federal Reserve moves to stop bond yields from rising, the economy would not get any stability in the debt market. Mannarino stated that the world will definitely march right into a liquidity crisis the moment the debt market begins to implode. This, in turn, will melt down 80 percent of the stock market.

The financial expert believes this crisis is “well-staged and engineered.”

“When I tell you it’s over, I’m not just talking about the stock market, it would be the whole financial system,” he warned. “They’re setting it up and all of this is just the prelude to what’s going to come, a liquidity crisis, credit freeze and this whole system is going to lock up, people are going to be in the streets,”

The finance forecaster said there is an effort to create an illusion of liquidity, with economic manipulators passing cash back and forth between institutions.

“This is just a Ponzi scheme, and in order for the racket to work, it has to continue to find other investors to participate in the scheme. And like every other Ponzi [scheme], it will collapse.”

JPMorgan CEO warns public of “economic hurricane”

JPMorgan Chase CEO Jamie Dimon warned the public as early as June that an economic hurricane is coming. “I said there are storm clouds, but I’m going to change it. It’s a hurricane,” Dimon said during his speech at a financial conference in New York. (Related: GET READY: JPMorgan CEO Jamie Dimon says “economic hurricane” is about to make landfall across America.)

The Ukraine war had a massive impact on commodities, including food and fuel. “Oil almost has to go up in price because of disruptions caused by the worst European conflict since World War II,” Dimon said.

The financial services chief also noted that the so-called quantitative tightening (QT) ramped up to $95 billion a month in reduced bond holdings. “We’ve never had QT like this, so you’re looking at something you could be writing history books on for 50 years. Several aspects of quantitative easing programs backfired, including negative rates,” he added.

Inflation is at a multi-decade high and exacerbated by supply chain disruptions and the Wuhan coronavirus (COVID-19) pandemic. It has sown fear that the Fed will inadvertently tip the economy into recession as it combats price increases.

The reasons for the collapse that the CEO cited were inflation and the Russia-Ukraine conflict.

Meanwhile, in an apparent effort to “magnify” the implosion, Treasury Secretary Janet Yellen admitted back in May that she was wrong when she said last year that the trajectory of inflation would be a “small risk.”

“As I mentioned, there have been unanticipated and large shocks to the economy that have boosted energy and food prices and supply bottlenecks that have affected our economy badly that I didn’t at the time didn’t fully understand. But we recognize that now,” Yellen said.

Visit MarketCrash.news for more updates about the looming market and financial system crash.

Watch Gregory Mannarino issue a warning about the financial system’s engineered meltdown below.

This video is from the What is happening channel on Brighteon.com.

More related stories:

MILLIONS of Americans to be EVICTED from their homes as economic collapse accelerates.

Sources include:

Submit a correction >>

Tagged Under:

big government, Bubble, chaos, Collapse, conspiracy, crisis, debt bomb, debt collapse, deception, economic collapse, economy, Federal Reserve, finance, Gregory Mannarino, Inflation, Jamie Dimon, market crash, money supply, Ponzi scheme, risk, stock market

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 PENSIONS.NEWS

All content posted on this site is protected under Free Speech. Pensions.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. Pensions.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.