Walmart continues to lose customers as inflation forces Americans to turn to dollar stores

08/12/2022 / By Arsenio Toledo

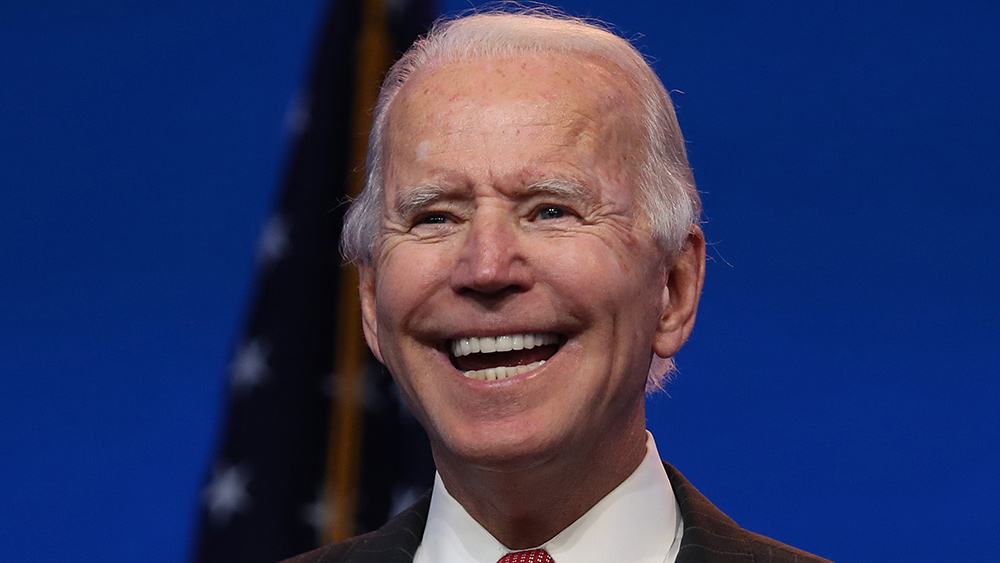

Many of Walmart’s former customers have yet to return to shopping at the retail chain as President Joe Biden’s inability to keep inflation under control makes even their discounted prices less appealing than shopping at dollar stores.

According to an analysis conducted by Reuters, foot traffic at Walmart’s 3,573 supercenters in the United States and its 370 other discount stores fell by 2.7 percent on average from June 1 to July 25 compared to the same period last year. (Related: More high-income Americans are shopping at discount stores due to unrelenting inflation.)

Meanwhile, foot traffic for German-owned discount Store Aldi rose by 11.5 percent. For Dollar General, the number of shopper visits grew by 4.1 percent.

Overall, Placer.ai, a location analytics firm, said foot traffic to discount stores like Aldi, Dollar General, Family Dollar and Dollar Tree grew by eight percent during the second quarter year-over-year and jumped 13.2 percent compared with the first quarter of 2022.

According to Numerator, a consumer insights firm, Walmart shoppers have a median household income of $73,000 annually. Meanwhile, Dollar General’s core demographic is families making $40,000 or less per year.

Due to the sudden influx of new, higher-earning customers, Dollar General has widened its product selection to reflect the increase in sales outside of its core demographic.

Fuel prices keeping Americans at discount stores

Walmart CEO Doug McMillon had previously characterized the retail chain as an “inflation-fighter” and a top destination for shoppers during recessionary periods. But Walmart’s share as the first choice of consumers for grocery purchases dropped from 27.4 percent in June to 25.5 percent in July as more Americans turn to discount stores.

Reuters’ analysis noted that gasoline prices may be one of the main reasons keeping Walmart’s former customers from returning to the big-box store.

Gasoline prices in June soared to an average of $5 per gallon, up from around $3.16 per gallon last year. Higher gas prices are shaving hundreds of dollars off the monthly spending budgets of Americans, forcing many to change their spending habits.

For July, monthly spending on gas rose to around 5.57 percent of the income of a typical American household – which earns an average of $5,412 per month after taxes. This is up from gas spending only consisting of 2.79 percent of household budgets in Dec. 2019.

McMillon told investors that Walmart shoppers – especially those belonging to lower-income households – have been purchasing fewer items during the three months through April 30. They have also been consolidating their trips to the store in response to higher fuel prices.

Jason Benowitz, senior portfolio manager for the Roosevelt Investment Group, noted that while Walmart’s main advantage is in its ability to offer a larger selection of goods, the convenient locations of dollar stores offer a significant advantage, especially as fuel prices remain high. While Walmart only has around 5,300 stores in the U.S., Dollar General operates more than 18,400 stores.

“The driving distance for a typical shopper across much of the U.S. may be twice as far to reach the nearest Walmart as compared to a dollar store,” said Benowitz.

Learn more about how inflation is changing Americans’ spending habits at Inflation.news.

Watch this episode of the “Health Ranger Report” as Mike Adams, the Health Ranger talks about how more Americans are shifting food shopping to dollar stores.

This video is from the Health Ranger Report channel on Brighteon.com.

More related articles:

Americans relying more and more on DOLLAR STORES as inflation worsens.

American consumers turn to cheaper store brands as commodity prices continue to soar.

Analysis: Dollar stores are WINNING as Americans lose to inflation.

American workers have lost $3,400 in yearly income due to unrelenting inflation.

Sources include:

Submit a correction >>

Tagged Under:

Bubble, Collapse, consumer habits, debt bomb, debt collapse, discount stores, dollar stores, economic collapse, economic crisis, economy, fuel prices, gas prices, grocery, Inflation, market crash, money supply, risk, shopping habits

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 PENSIONS.NEWS

All content posted on this site is protected under Free Speech. Pensions.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. Pensions.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.